As real estate investors, our core mission is to maximize return on investment (ROI), secure appreciating assets, and generate strong passive income streams. In recent years, one term has moved from a regulatory concept to a powerful investment vehicle: the Accessory Dwelling Unit (ADU).

If you’ve been hearing whispers about “granny flats,” “in-law suites,” or “backyard cottages,” you’re hearing about ADUs. But what is an ADU in real estate exactly, and why should it be on every savvy investor’s acquisition and development checklist? Let’s dive in.

What is an ADU in Real Estate? The Investment Asset

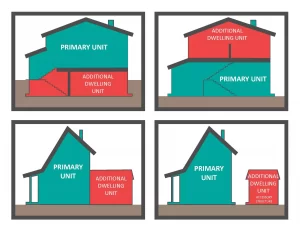

At its core, an ADU is a secondary, self-contained dwelling unit located on the same lot as a primary single-family home. Think of it as a complete, independent rental property with its own kitchen, bathroom, sleeping area, and separate entrance, all operating on an existing parcel of land.

These units are “accessory” because they are secondary to the primary residence and cannot be sold separately.

Common Types of ADUs for Investment:

- Detached ADUs (The Strongest ROI): Stand-alone structures in the backyard, offering the most privacy and commanding the highest rental rates.

- Conversion ADUs (The Fastest ROI): Converting underutilized space like a garage, basement, or attic, which often requires a lower initial investment and speeds up the time to market.

- Attached ADUs: An addition built onto the main home.

Why ADUs are a Game-Changer for Real Estate Investors

Understanding what is an ADU in real estate is crucial, but the real benefit lies in the financials. Here is why ADUs are a high-value strategy for investors:

- Immediate Cash Flow and High Cap Rates: This is the most compelling reason. An ADU provides an entirely new stream of rental income from a single existing property. For investors, this significantly boosts the property’s gross operating income, which translates directly to higher capitalization rates and faster payback on the construction cost.

- Forced Equity Appreciation: Building a new, fully permitted unit is a form of “forced appreciation.” The cost to build an ADU is often far less than the value it adds to the final appraisal of the property. This strategy is excellent for investors looking to refinance quickly and pull out capital for the next deal.

- Risk Mitigation through Diversification: With two units on one lot, you diversify your rental income. If the main house sits vacant for a month, you still have rent coming in from the ADU, lowering your vacancy risk and making the asset more resilient.

- Meeting Market Demand for Affordable Housing: ADUs naturally meet a strong market demand for smaller, private, and more affordable living spaces in desirable neighborhoods. This means you attract a wider pool of renters and reduce your time-to-lease.

- Land Use Optimization: You are maximizing the use of your existing real estate. Instead of a dormant backyard or garage, the ADU transforms this underutilized space into a productive, income-generating asset.

Navigating the Investment Hurdles: What Investors Need to Know

While the profit potential is strong, savvy investors must prepare for specific challenges:

- Initial Capital Outlay: Construction requires a significant upfront investment. Investors must carefully budget and secure financing, whether through cash-out refinancing, HELOCs, or construction loans.

- Regulatory Compliance: Navigating local zoning codes, setback requirements, and utility hookups can be complex. Consulting local ADU specialists and design-build firms is essential to avoid costly delays.

- Project Timeline and Overruns: As with any construction project, delays and cost overruns are common. Investors must build a healthy contingency budget (typically 15-20% of the build cost) into their financial model.

- Utility Infrastructure: Ensure the existing property’s water, sewer, and electrical systems can handle the increased load. Upgrades to utility lines can be a significant, often unexpected, expense.

The Investor Advantage: Dual Income on a Single Lot

For real estate investors looking to supercharge their portfolios and maximize density within existing zoning, understanding what is an ADU in real estate is the key to unlocking the next level of wealth creation. These dual-income properties are highly attractive, financially resilient, and a sustainable way to build a robust investment portfolio.

By thoroughly analyzing local regulations and building a strong development team, investors can confidently add these valuable, income-producing units to their assets.

Would you like me to provide a list of common financing options that real estate investors use to fund ADU construction?